In Phoenix, AZ's dynamic retail sector, effective business interruption management involves assessing risks from natural disasters, man-made incidents, and cyberattacks. Business Interruption Insurance is crucial for financial protection during forced closures or reduced revenue due to covered events. Retailers should tailor insurance policies based on regional risks, implement robust risk management policies, and conduct regular policy reviews to adapt to changing dynamics, ensuring business continuity and maintaining competitiveness in the market.

In the dynamic retail landscape of Phoenix, AZ, effective risk management is paramount to business survival. This article guides you through critical components of retail risk mitigation, focusing on business interruption scenarios that could cripple your operation. We explore comprehensive strategies for implementing robust policies and highlight the significance of Business Interruption Insurance in Phoenix to safeguard your retail venture against unforeseen disruptions, ensuring resilience and continuity.

- Assessing Risks: Business Interruption Scenarios in Phoenix, AZ

- Implementing Policies: Effective Strategies for Retail Businesses

- Insurance Coverage: Protecting Your Phoenix Retail Operation with Business Interruption Insurance

Assessing Risks: Business Interruption Scenarios in Phoenix, AZ

In the dynamic landscape of Phoenix, AZ’s retail sector, assessing risks is paramount for effective business interruption management. Businesses must be prepared to navigate unforeseen events that could disrupt operations, from natural disasters like wildfires and severe storms to man-made incidents and cyberattacks. Understanding these potential interruptions is key to developing robust risk mitigation strategies.

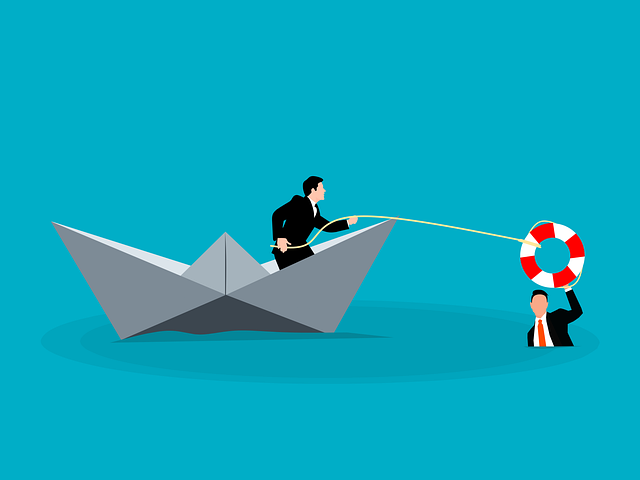

Business Interruption Insurance plays a crucial role in Phoenix Az retail operations, offering financial protection during periods of forced closure or reduced revenue due to covered events. By evaluating risks specific to the region, including climate patterns and geopolitical factors, retailers can tailor their insurance policies accordingly. This proactive approach ensures that businesses are not only insured but also resilient in the face of potential interruptions, enabling them to quickly recover and resume operations without significant financial strain.

Implementing Policies: Effective Strategies for Retail Businesses

Implementing robust risk management policies is paramount for retail businesses aiming to thrive in a dynamic marketplace. A well-structured approach begins with assessing unique risks specific to the industry, such as inventory loss, fraud, and unpredictable market fluctuations. Retailers should then develop comprehensive guidelines that outline preventive measures and response strategies for potential crises.

One key strategy involves securing adequate Business Interruption Insurance in Phoenix, AZ, which provides financial protection during unexpected events like natural disasters or cyberattacks, ensuring business continuity and rapid recovery. Additionally, regular policy reviews and updates are essential to adapt to evolving risks and regulatory changes, thereby safeguarding the future of the retail operation.

Insurance Coverage: Protecting Your Phoenix Retail Operation with Business Interruption Insurance

Business Interruption Insurance is an essential component of risk management for any retail operation in Phoenix, AZ. This type of insurance offers crucial protection against unforeseen events that can halt business activities, such as natural disasters, equipment failures, or civil unrest. By securing this coverage, retailers can safeguard their financial stability and ensure a faster recovery following disruptions.

When considering Business Interruption Insurance in Phoenix, it’s important to understand the various policy options available. These policies typically cover lost revenue and additional expenses incurred during a period of temporary closure or reduced operations. Retailers should assess their specific needs, including the potential impact of seasonal fluctuations, market changes, or industry-specific risks. With the right coverage, businesses can navigate challenges more resiliently, ensuring they remain competitive and profitable in the vibrant Phoenix retail landscape.

Retail businesses in Phoenix, AZ, face unique risks, especially regarding business interruptions. By assessing potential scenarios and implementing robust policies, retailers can better protect their operations. Business Interruption Insurance Phoenix Az is a vital component of any comprehensive risk management strategy, ensuring that businesses can recover swiftly from unforeseen events. Through proactive measures and the right coverage, retailers can navigate challenges and thrive in a competitive market.